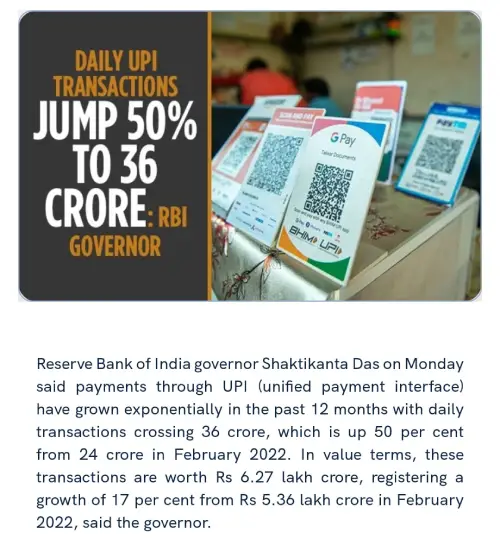

Daily UPI transactions jump 50% to 36 Crore: During the launch of Digital Payments Awareness Week at the RBI headquarters, Governor Shaktikanta Das announced that payments made through UPI (unified payment interface) have experienced significant growth over the past year. Daily transactions have surpassed 36 crore, indicating a 50% increase from 24 crore in February 2022. Additionally, these transactions are valued at Rs 6.27 lakh crore, showing a growth rate of 17% from Rs 5.36 lakh crore in February 2022. Over the past three months, he noted that the total monthly digital payment transactions have exceeded the Rs 1,000-crore threshold each month.

★★ Latest Current Affairs ★★

Governor Das stated that the success of India’s payment systems has drawn global attention, with various countries expressing interest in replicating it. He further expressed pride in the fact that the payment systems have consistently witnessed more than 1,000 crore transactions every month since December 2022. This showcases the strength and reliability of the payments ecosystem and its acceptance among consumers. A nationwide digital payments survey, which surveyed 90,000 respondents, recently revealed that 42% of them have utilized digital payments.

★★ Current Affairs Quiz ★★

Daily UPI transactions jump 50% to 36 Crore

- The number of UPI transactions exceeded 800 crore in January 2023, while NEFT witnessed the highest ever daily volume of 3.18 crore transactions on February 28.

- UPI has emerged as the most popular payment mode since its launch in 2016 and accounts for 75% of total digital payments, pioneering person-to-person and person-to-merchant transactions.

- UPI transactions have increased from 0.45 crore in January 2017 to 804 crore in January 2023, with the value of transactions increasing from Rs 1,700 crore to Rs 12.98 lakh crore during the same period.

- The RBI has created over 48 crore card tokens, which have processed over 86 crore transactions, making it the world’s biggest tokenisation exercise.

- Customer-friendly recurring mandate framework has increased e-mandates from 2-3 crore earlier or worth Rs 130 crore, to around 15 crore or worth Rs 1,700 crore now.

- Acceptance of digital payments infrastructure has increased from 17 crore touch points to 26 crore touch points, which is an increase of 53%.

- Governor Das launched ‘Har payment digital’ mission which seeks to reinforce RBI’s commitment to deepen digital payments in the country.

- The Bharat bill payment system (BBPS) and the national electronic toll collection (NETC) system have helped migrate bill and toll payments to digital modes.

- The national automated clearing house (NACH) system has facilitated direct benefit transfers (DBT) payments digitally and eliminated leakages in the system.

- The RBI has decided to adopt 75 villages by involving village-level entrepreneurs as part of the 75 digital villages programme.

- Deputy Governor Rabi Sankar said digital payments have grown 15% annually over the past five years, and the digital vision 2025 of the RBI is to ensure digital payments by everyone, everywhere, and every time.

This article has provided you with insightful information on the Daily UPI transactions jump 50% to 36 Crore. To stay updated on current happenings, we recommend following freshersnow.com on a daily basis.