Kisan Credit Card @ pmkisan.gov.in | KCC Loan Scheme, Apply Online, Eligibility, Apply Online: The Kisan Credit Card scheme was launched by the Government of India, Department of Agriculture, Cooperation & Farmers Welfare and Ministry of Agriculture & Farmers Welfare. The motto of this scheme is to provide financial support to the farmers and to make them meet their cultivation needs. Farmers can apply for the Kisan Credit Card Scheme to get benefits from PM Kisan Samman Nidhi and Loan from various banks. Moreover, the interest rate can be as low as 2.00% under this scheme.

Through this article, we have provided all important information related to Kisan Credit Card. Candidates can check the KCC Loan Scheme Details, Online Application Process, Eligibility, Documents, PM KCC Application Form Status, Interest Rate, Benefits, and related links in the below sections.

Kisan Credit Card – Overview

| Name of the Scheme | Kisan Credit Card |

| Concerned Department | Department of Agriculture, Cooperation & Farmers Welfare, Ministry of Agriculture & Farmers Welfare, Govt. of India |

| Beneficiary | Farmers |

| Objective | To provide financial support to farmers |

| KCC Scheme Launched under | PM Kisan Samman Nidhi |

| Scheme Launched by | Pradhan Mantri Shri Narendra Modi |

| Loan Amount for KCC Holders | Upto Rs. 3 Lacs @ 2% P.A. |

| Official site | pmkisan.gov.in |

Kisan Credit Card (KCC)

This was launched in 1998 which was developed by the National Bank for Agriculture and Rural Development (NABARD). This KCC scheme was launched to provide credit support to the farmers to meet their agricultural needs. Farmers involved in Agriculture, Fisheries, and Animal Husbandry are included under this scheme. Under this scheme, short term loan for crops and term loan is provided. Moreover, with the help of KCC, farmers are exempt from the higher interest rates of the regular loans offered by banks as the interest rate for KCC starts as low as 2%. With the help of this scheme, farmers can repay their loans depending on the harvesting period of their crops for the given loan.

Benefits of Kisan Credit Card

- Bank will provide secured loans up to Rs 1.60 lakh.

- There will be decreased by 2% of the interest.

- The maximum of Rs 3 lakhs can be taken by the cardholders.

- A simple interest will be charged will repay the loan.

- Farmers are provided insurance coverage against permanent disability, death, other risks that are also provided to the farmer.

- Compound interest is charged when cardholders fail to make timely payments.

KCC Insurance for Farmers

- KCC provides personal accident insurance coverage up to Rs. 50,000/- For death.

- In case of an accident resulting in disability Rs. 25,000/-.

Loan Repayment Covered in Kisan Credit Card

- Principle or interest components.

- Bullet repayments

- EMIs

- Credit card statements

Eligibility Criteria for Kisan Credit Card

- Minimum age – 18 years

- Maximum age – 75 years

- All farmers – Individuals/ Joint cultivators, Owners

- SHGs or joint liability groups including tenant farmers.

- Senior citizens must have the co-borrowers in mandatory.

Documents Required for Kisan Credit Card

Identity Proof

- PAN Card.

- Aadhar Card.

- Voter’s ID Card.

- Passport.

- Driving Licence.

- Any other Government approved photo ID).

Address Proof

- Aadhar Card.

- Passport.

- Utility bills (not more than 3 months old).

- Any other government approved address proof.

Income Proof

- Bank statement for the last 3 months.

- Salary slips for the last 3 months.

- Audited financials for the last two years (for self-employed) & Form 16.

How To Apply For Kisan Credit Card?

Online Process

- Login the website of the bank you wish to apply for the KCC scheme.

- Now choose the Kisan Credit Card.

- Next click on the Apply option.

- Now you will redirect to the application page.

- Fill the form with the required details and click on submit option.

- Next, an application reference number will be sent.

- If you are eligible, the bank will get back to you for the further process within 3-4 working days.

Offline Process

The applicant can visit the branch and begin the application process with the help of the bank representative. Once the formalities are done, the bank’s loan officer can help with the loan amount for the farmer.

KCC Yojana Online Apply through PM Kisan Portal

- First login the official website of PM Kisan @ pmkisan.gov.in

- On the homepage, click on the Download KCC Form option.

- Now PDF form of KCC Application Form will appear.

- Next Print the application form.

- Fill the necessary details in the application form.

- Attach all the necessary documents and visit the concerned bank.

- After completing all the formalities, the bank will issue a Kisan credit card on the basis of the applied loan.

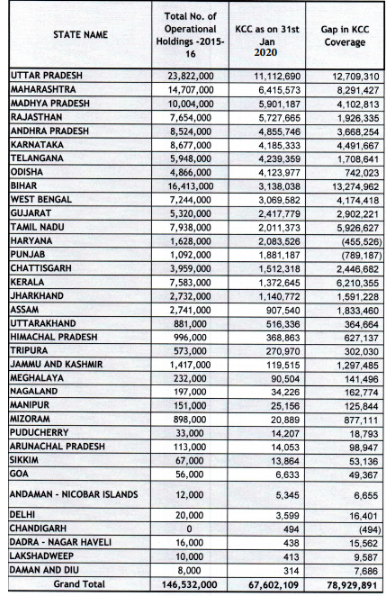

Active KCCs State / U.T. Wise

KCC Links of Top Banks

- SBI KCC Link – Apply Here

- HDFC KCC Link – Apply Here

If you want to get more details on Kisan Credit Card, you can visit our portal at Freshers Now.