Silicon Valley Bank Collapse: Silicon Valley Bank, a major player in the US technology and startup sector headquartered in Santa Clara, California, experienced a significant financial collapse, making it one of the biggest bank failures since the 2008 financial crisis. Just two days prior to this event, SVB had revealed plans for a share sale to address the unexpectedly rapid decrease in deposits. Once news of the bank’s failure spread, both investors and customers began abandoning it.

What happened at Silicon Valley Bank?

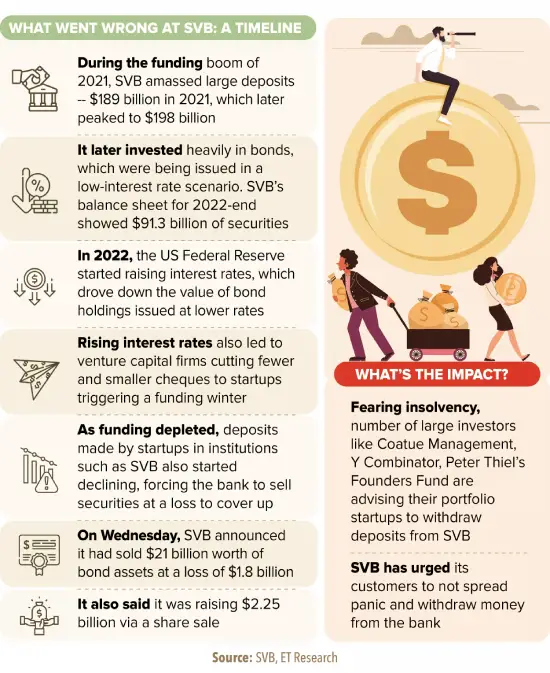

SVB Financial Group declared its intention to raise $2.25 billion through a share sale, in addition to selling securities from its portfolio worth $21 billion. The company further reported incurring an enormous after-tax loss of $1.8 billion from these sales.

![]()

Due to the US Federal Reserve’s aggressive interest rate hikes to control inflation, the worth of pre-existing bonds issued at lower interest rates has diminished. Consequently, banks that purchased these bonds are facing substantial unrealized losses. Additionally, the rise in interest rates has led to a reduction in startup funding, as the venture capital industry has slowed down.

Impact of Silicon Valley Bank Collapse on Indian Startups

The recent events in the US have left Indian investors and SaaS startups uneasy. While some are closely monitoring the situation, others are already transferring their funds from SVB. “We transferred 90% of our funds from SVB to Brex in the first half of Thursday – I did so even before receiving any recommendation from VC funds,” stated Ashray Malhotra, the founder and CEO of Rephrase.ai, backed by Lightspeed. Early-stage SaaS startups now prefer new-age lenders, such as Mercury and Brex, as their go-to platforms.

What will happen next?

The California Department of Financial Protection and Innovation closed SVB, as reported by the US Federal Deposit Insurance Corporation (FDIC). In order to secure the insured depositors, the FDIC established the Deposit Insurance National Bank of Santa Clara (DINB) and transferred all insured deposits of Silicon Valley Bank to it immediately upon closure. The FDIC will sell SVB’s assets, while the DINB will continue with its regular business operations. The insured depositors will receive their insured deposits, while the uninsured depositors will receive dividends from the sale of assets.

We beliebe that you have acquired information on the collapse of Silicon Valley Bank from this article. To stay updated on the latest events, be sure to follow FreshersNow.com.